What are limit orders and market orders?

Market Orders

A Market Order is an immediate purchase or sale of a security. This type of order ensures that the order will be executed, but it does not guarantee the price of execution.

A Market Order will typically execute at or near the current; ask price, in case a person has executed a buy order or; bid price, in case a person has executed a sell order.

Investors should keep in mind, that the last traded price is not always the price at which a market order will be filled. The buy order is executed at the lowest price a seller is willing to accept for security and the sale is order is executed at the highest price buyer is willing to pay for security.

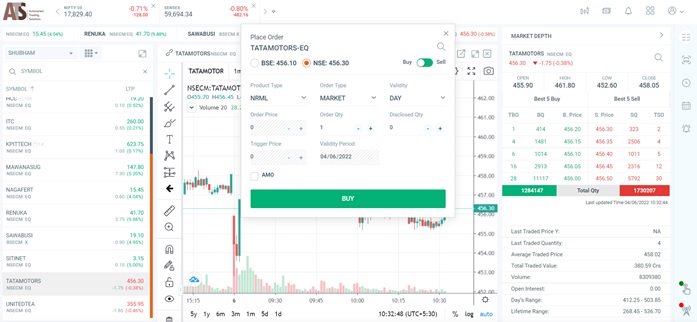

Example:

Let's imagine you go online at 11:00 a.m. and find that TATA Motors' stock is trading at ₹400 per share. If you place a market order to buy 100 shares, it will almost certainly be executed in seconds, and you will spend roughly ₹40,000 (100 shares x ₹400 a share) plus any commissions or other fees. However, if the stock or market is volatile, the price you pay (or receive, if you're selling) may differ from the price you saw just before placing the order.

Limit Orders

Limit orders are used to provide investors with more control over the prices at which their trades are bought and sold. A maximum acceptable purchase price is set before placing a buy order and a minimum acceptable selling price is set on sales orders.

A limit order gives you the assurance that the market's entrance or exit point is at least as good as the price you set. When trading in a stock or other asset that is thinly traded, extremely volatile, or has a wide bid-ask spread (the difference between the highest price a buyer is ready to pay for an asset in the market and the lowest price a seller is willing to take), limit orders can be very useful. A limit order establishes a limit on how much an investor is ready to spend.

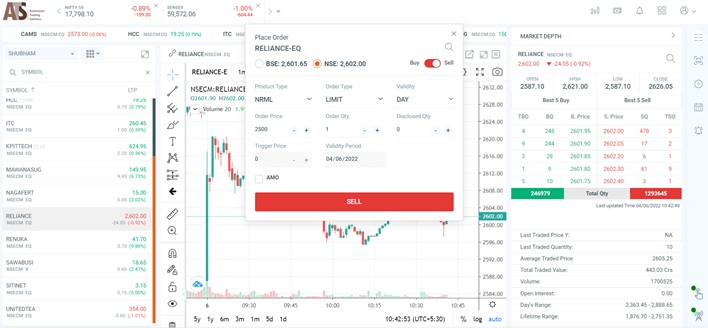

Example:

Let's imagine you wish to buy Reliance Industries stock, which is trading around at ₹2600, for no more than ₹2500 per share. You can place a limit order for ₹2500, and it will only be executed if the price of Reliance stock falls to that level or lower. Your limit order would immediately go through if Reliance Industries stock fell from ₹2600 to ₹2500 later. Thus, a limit order can be of great use when you have pre-decided a price of when to buy and when to sell the stock.

For further queries regarding investments, financial planning and guidance, please call us at +91 7305923322

Please write to us at research@adityatrading.com

To read more posts like this, check in to https://adityatrading.in/

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.