SPECIAL REPORT CENTURY TEXTILE & INDUSTRIES LTD

Century Textiles & Industries Limited - Company Profile

Incorporated in 1897, Century Textiles & Industries Limited manufactures cotton textile products and has presence in the yarn, denim, caustic soda, sulphuric acid, salt, cement, and pulp and paper industries.

Century Textiles & Industries Limited 100 % cotton yarn unit and its denim unit are both situated in Madhya Pradesh. The cotton yarn unit has a capacity of 24,960 spindles and the denim unit produces 21 million metres of denim fabric per year.

Century Textiles & Industries Limited cement segment manufactures and markets cement and clinker products for use in water tanks, roads, bridges, dams, sea walls, turbine blocks, and residential or multi-storeyed buildings under the Birla Gold brand. Century Textiles & Industries Ltd has three cement plants at different locations, with a total cement manufacturing capacity of 7.8 million tonnes per annum.

Century’s pulp and paper plant has a capacity of 31,320 tonnes per annum, writing and printing paper capacity of 1,97,800 tonnes per annum and a capacity of 36,000 tonnes per annum for tissue paper. The Company has set up a 500- tonnes per day multilayer packaging board plant adjacent to its existing pulp and paper plant at Lalkua, Uttarakhand.

Century Textiles & Industries Limited - STOCK INFORMATION

|

STOCK PRICE |

573.25 |

|

TARGET PRICE |

590-605 |

|

SECTOR |

CEMENT&CEMENT PRODUCT |

|

SYMBOL (AT NSE) |

CENTURYTEX |

|

ISIN |

INE055A01016 |

|

FACE VALUE (IN RS.) |

10.00 |

|

BSE CODE |

500040 |

Century Textiles & Industries Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

5,318.03 |

|

BOOK VALUE |

187.80 |

|

EPS - (TTM) (IN RS. CR.) |

6.87 |

|

P/E |

83.20 |

|

INDUSTRY P/E SHAREHOLDING PATTERN |

16.65 |

INVESTMENT RATIONALE

CENTURY TEXTILE has 40 acres of mill land in Worli, one of Mumbai’s most attractive real estate micro-markets. Recent transactions/PE deals in Central Mumbai have materialized at a valuation of INR1.6b-1.8b/acre. Going ahead, we believe cost savings from upcoming CPP (would meet 80% requirement) and new cement plants with better operating efficiency will enhance operating margins, though it will be difficult to completely bridge the gap with peers. We expect 19% CAGR in cement EBITDA/ton over FY14-15 to INR734.

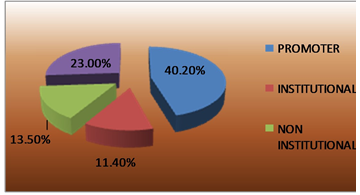

SHAREHOLDING PATTERN

OUTLOOK AND VALUATION

While the cement business is poised for steady improvement, acute margin pressure in non-cement segments, high leverage (FY15E net debt-equity of 4.9x) and delay in real estate value unlocking would limit upside potential. CENT trades at 11.1x FY15E EBITDA. For the cement business, this implies FY15E EV of USD72/ton v/s USD64/ton for MOSL Mid Cap Cement Universe and USD111/ton for overall Cement Universe. Our SOTP-based valuation is INR460/share: (1) cement (USD75/ ton), (2) paper (1x FY15E sales), (3) textiles (0.4x FY15E sales), and (4) land (FY15E NAV). We initiate coverage with a buy rating; our target price 605 levels.

RESULTS (Quarterly )(Rs CR.)

|

|

SEP' 14 |

JUN' 14 |

MAR' 14 |

DEC' 13 |

SEP' 13 |

|

Sales |

1,705.83 |

1,887.37 |

1,849.07 |

1,639.33 |

1,586.69 |

|

Operat- ing profit |

155.67 |

204.94 |

183.47 |

168.05 |

148.58 |

|

Interest |

109.26 |

96.26 |

93.70 |

90.47 |

91.13 |

|

Gross profit |

57.27 |

116.14 |

97.66 |

84.21 |

66.43 |

|

EPS (Rs) |

0.08 |

7.15 |

-0.53 |

0.17 |

-3.40 |

TECHNICAL VIEW

CENTURY TEXTILE LTD is looking strong on charts. We advise to buy around 565-575 with stoploss of 545 for the targets of 590- 605 levels. RSI is also showing upside momentum in it on daily charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

66.062 |

BUY |

|

STOCH(9,6) |

66.352 |

BUY |

|

STOCHRSI(14) |

100.000 |

OVERBOUGHT |

|

MACD(12,26) |

-16.880 |

SELL |

|

ADX(14) |

24.967 |

BUY |

|

WILLIAMS %R |

-3.646 |

OVERBOUGHT |

|

CCI(14) |

182.9524 |

BUY |

|

ATR(14) |

18.5250 |

LESS VOLATILITY |

|

HIGH/LOWS(14) |

29.9071 |

BUY |

|

ULTIMATE OSCILLATOR |

61.636 |

BUY |

|

ROC |

10.314 |

BUY |

|

BULL/BEAR POWER()13 |

46.3260 |

BUY |

|

BUY: 8 SELL:1 NEUTRAL: 2 |

SUMMARY : STRONG BUY |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

INDIA CEMENT |

BUY |

102.45 |

101-103 |

98 |

105-109 |

ONE WEEK |

|

BHARAT FORGE |

BUY |

1023.30 |

1010-1025 |

980 |

1050-1080 |

ONE WEEK |

|

JAIN IRRIGATION |

BUY |

69.55 |

68-70 |

66 |

72-75 |

ONE WEEK |

|

SUNPHARMA |

BUY |

853.10 |

840-855 |

820 |

875-895 |

ONE WEEK |

|

ARVIND |

BUY |

274.50 |

272-275 |

268 |

279-284 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE / LOW/ HIGH |

|

TCS |

125 |

BUY |

2525 |

2460 |

2580-2620 |

6875.00 |

FIRST TGT HIT |

2538.30 / 2590.00 |

|

HEXAWARE |

|

BUY |

210.30 |

205 |

214-218 |

16000.00 |

BOTH TGT HIT |

217.60 / 220.40 |

|

NMDC |

|

BUY |

135.30 |

134 |

144-148 |

0.00 |

NOT OPEN |

135.70 / 137.25 |

|

JUST DIAL |

|

BUY |

1471.85 |

1430 |

1490-1520 |

7500.00 |

BOTH TGT HIT |

1547.60 / 1593.90 |

|

INTELLECT |

|

BUY |

115.70 |

104 |

120-125 |

10000.00 |

BOTH TGT HIT |

126.95 / 134.40 |

|

WOCKPHARMA |

|

BUY |

1080.25 |

1058 |

1090-1100 |

10000.00 |

BOTH TGT HIT |

1036.60 / 1118.00 |

|

NET PROFIT |

|

|

|

|

|

50375.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.