Puravankara Projects Ltd.

|

Current price BSE |

65.60 |

|

Sector |

Real Estate |

|

No of shares |

237149686 |

|

52 week high |

133.90 |

|

52 week low |

63.00 |

|

BSE Sensex |

28192.02 |

|

Nifty |

8550.90 |

|

Average Volume |

189973 |

|

BSE Code |

532891 |

|

NSE Symbol |

PURVA |

Puravankara Projects Limited - Company Overview

The Puravankara Projects Limited (PPL) was incorporated on 3rd June 1986 in Mumbai as a private limited company under the name of Puravankara Constructions Private Limited. Now it emerged as a leading real estate developer, provides residential flats and commercial, serving the needs of a discerning clientele. Puravankara Projects Ltd operations cover Bangalore, Kochi, Chennai, Coimbatore, Hyderabad, Mysore, Colombo and the United Arab Emirates (U.A.E). Also have representatives in the United Kingdom and the United States. The network of the company expanded to Bangalore in the year 1987 and commenced its operations in Bangalore during the year 1990, also launched its first residential project.

Puravankara has the distinction of being the first developer to obtain FDI in the Indian real estate industry through its joint venture with Singapore based Keppel Land Limited, the property arm of the 54% government owned conglomerate, Keppel Corporation Limited. The joint venture company, Keppel Puravankara Development Private Limited, has ongoing housing projects in India.

Puravankara Projects Ltd has grown from strength to strength, having successfully completed 36 residential / commercial projects spanning 7.80 million square feet. Currently, it has 29 million square feet of projects under development, with an additional 88 million square feet in projected development over the next 7-10 years. An ISO 9001 certification by DNV in 1998 and a DA2+ rating by CRISIL are testament to Puravankara’s reputation as a real estate developer of the highest quality and reliability standards.

Puravankara Projects Limited (PPL) was certified as an ISO 9001 compliant company by DNV in the year 1998. Puravankara Projects (PPL) made its foray into the affordable housing segment and launched a 100% owned subsidiary called Provident Housing and Infrastructure during in August of the year 2008. The current market capitalization stands at Rs 1,554.52 crore.

Puravankara Projects Limited - Share Holding Pattern

|

Category |

No. of Shares |

Percentage |

|

Promoters |

177,862,264 |

75.00 |

|

Foreign Institutions |

23,507,160 |

9.91 |

|

NBFC and Mutual Funds |

19,016,963 |

8.02 |

|

Other Companies |

5,057,947 |

2.13 |

|

Foreign - OCB |

4,660,598 |

1.97 |

|

General Public |

3,964,674 |

1.67 |

|

Financial Institutions |

2,213,033 |

0.93 |

|

Others |

457,696 |

0.19 |

|

Foreign - NRI |

405,431 |

0.17 |

|

Directors |

3,920 |

0.00 |

Puravankara Projects Limited - Financial Details

-

Market Cap (Rs Cr) – 1561.63

-

Company P/E (x) – 13.07

-

Industry P/E (x) – 29.69

-

Book Value (Rs) – 76.36

-

Price / BV (x) – 0.86

-

Dividend (%) – 38.40%

-

EPS (TTM) – 5.04

-

Dividend Yield (%) –2.92%

-

Face Value - 5

Puravankara Projects Limited - Industry Overview

The Indian real estate sector is one of the most globally recognized sectors. In the country, it is the second largest employer after agriculture and is slated to grow at 30 percent over the next decade. It comprises four sub-sectors - housing, retail, hospitality, and commercial. The growth of this sector is well complemented by the growth of the corporate environment and the demand for office space as well as urban and semi-urban accommodations. It is also expected that this sector will incur more non-resident Indian (NRI) investments in the near future, as a survey by an industry body has revealed a 35 percent surge in the number of enquiries with property dealers.

The Indian real estate market size is expected to touch US$ 180 billion by 2020. The housing sector alone contributes 5-6 percent to the country's gross domestic product (GDP). Also, in the period FY08-20, the market size of this sector is expected to increase at a compound annual growth rate (CAGR) of 11.2 per cent. Retail, hospitality and commercial real estate are also growing significantly, providing the much-needed infrastructure for India's growing needs.

Real estate has emerged as the second most active sector, raising US$ 1.2 billion from private equity (PE) investors in the last 10 months. Foreign investors have bought tenanted office space worth over US$ 2 billion in India in 2014, a four-fold rise compared to the previous year, in order to increase their rent-yielding commercial assets in Asia's third largest economy.

The Indian real estate sector has witnessed high growth in recent times with the rise in demand for office as well as residential spaces. According to data released by Department of Industrial Policy and Promotion (DIPP), the construction development sector in India has received foreign direct investment (FDI) equity inflows to the tune of US$ 24,012.87 million in the period April 2000-December 2014.

Balance Sheet

|

|

Mar '14 |

Mar '13 |

Mar '12 |

Mar '11 |

Mar '10 |

|

Income |

|

|

|

|

|

|

Sales Turnover |

922.68 |

815.26 |

527.57 |

413.01 |

501.24 |

|

Net Sales |

922.68 |

815.26 |

527.57 |

413.01 |

501.24 |

|

Other Income |

43.86 |

2.59 |

0.96 |

9.08 |

7.00 |

|

Stock Adjustments |

455.74 |

176.67 |

508.71 |

0.00 |

0.00 |

|

Total Income |

1,422.28 |

994.52 |

1,037.24 |

422.09 |

508.24 |

|

Expenditure |

|

|

|

|

|

|

Employee Cost |

67.82 |

54.96 |

37.84 |

16.47 |

14.63 |

|

Other Manufacturing Expenses |

866.42 |

447.94 |

670.75 |

282.72 |

307.15 |

|

Selling and Admin Expenses |

0.00 |

0.00 |

0.00 |

21.07 |

12.93 |

|

Miscellaneous Expenses |

139.64 |

98.54 |

64.55 |

3.20 |

3.07 |

|

Preoperative Exp Capitalised |

0.00 |

0.00 |

0.00 |

-140.82 |

-104.03 |

|

Total Expenses |

1,073.88 |

601.44 |

773.14 |

182.64 |

233.75 |

|

Operating Profit |

304.54 |

390.49 |

263.14 |

230.37 |

267.49 |

|

PBDIT |

348.40 |

393.08 |

264.10 |

239.45 |

274.49 |

|

Interest |

201.11 |

220.83 |

192.15 |

143.46 |

106.86 |

|

PBDT |

147.29 |

172.25 |

71.95 |

95.99 |

167.63 |

|

Depreciation |

6.32 |

5.44 |

4.27 |

1.37 |

1.26 |

|

Profit Before Tax |

140.97 |

166.81 |

67.68 |

94.62 |

166.37 |

|

Extra-ordinary items |

0.00 |

0.00 |

2.12 |

-1.47 |

0.00 |

|

PBT (Post Extra-ord Items) |

140.97 |

166.81 |

69.80 |

93.15 |

166.37 |

|

Tax |

34.93 |

54.53 |

22.41 |

9.30 |

29.81 |

|

Reported Net Profit |

106.03 |

112.28 |

47.40 |

83.86 |

136.56 |

|

Total Value Addition |

1,073.88 |

601.44 |

773.14 |

182.64 |

233.76 |

|

Equity Dividend |

45.53 |

26.70 |

21.34 |

21.34 |

0.00 |

|

Corporate Dividend Tax |

7.74 |

4.54 |

3.46 |

3.54 |

0.00 |

|

Per share data (annualised) |

|

|

|

|

|

|

Shares in issue (lakhs) |

2,371.50 |

2,134.20 |

2,134.24 |

2,134.24 |

2,134.24 |

|

Earning Per Share (Rs) |

4.47 |

5.26 |

2.22 |

3.93 |

6.40 |

|

Equity Dividend (%) |

38.40 |

25.00 |

20.00 |

20.00 |

0.00 |

Profit and Loss Account

|

|

Mar '14 |

Mar '13 |

Mar '12 |

Mar '11 |

Mar '10 |

|

Sources Of Funds |

|

|

|

|

|

|

Total Share Capital |

118.58 |

106.71 |

106.71 |

106.71 |

106.71 |

|

Equity Share Capital |

118.58 |

106.71 |

106.71 |

106.71 |

106.71 |

|

Reserves |

1,692.32 |

1,477.42 |

1,396.37 |

1,373.78 |

1,316.67 |

|

Networth |

1,810.90 |

1,584.13 |

1,503.08 |

1,480.49 |

1,423.38 |

|

Secured Loans |

993.75 |

1,348.95 |

899.83 |

1,072.86 |

766.92 |

|

Unsecured Loans |

264.25 |

118.07 |

95.46 |

37.85 |

8.50 |

|

Total Debt |

1,258.00 |

1,467.02 |

995.29 |

1,110.71 |

775.42 |

|

Total Liabilities |

3,068.90 |

3,051.15 |

2,498.37 |

2,591.20 |

2,198.80 |

|

|

Mar '14 |

Mar '13 |

Mar '12 |

Mar '11 |

Mar '10 |

|

Application Of Funds |

|

|

|

|

|

|

Gross Block |

119.39 |

110.18 |

95.13 |

66.62 |

63.56 |

|

Less: Accum. Depreciation |

42.83 |

37.60 |

33.68 |

31.53 |

27.90 |

|

Net Block |

76.56 |

72.58 |

61.45 |

35.09 |

35.66 |

|

Capital Work in Progress |

0.21 |

0.55 |

1.87 |

1,045.69 |

1,153.68 |

|

Investments |

57.26 |

61.49 |

55.77 |

53.74 |

52.74 |

|

Inventories |

2,218.20 |

1,773.11 |

1,600.75 |

1,181.08 |

714.94 |

|

Sundry Debtors |

262.75 |

215.81 |

137.82 |

73.89 |

99.41 |

|

Cash and Bank Balance |

135.75 |

205.38 |

56.36 |

41.65 |

31.20 |

|

Total Current Assets |

2,616.70 |

2,194.30 |

1,794.93 |

1,296.62 |

845.55 |

|

Loans and Advances |

1,221.36 |

1,136.53 |

1,176.70 |

401.58 |

433.40 |

|

Fixed Deposits |

0.00 |

0.00 |

0.00 |

15.01 |

15.63 |

|

Total CA, Loans & Advances |

3,838.06 |

3,330.83 |

2,971.63 |

1,713.21 |

1,294.58 |

|

Current Liabilities |

841.90 |

384.32 |

559.32 |

227.42 |

309.98 |

|

Provisions |

61.30 |

29.98 |

33.02 |

29.12 |

27.85 |

|

Total CL & Provisions |

903.20 |

414.30 |

592.34 |

256.54 |

337.83 |

|

Net Current Assets |

2,934.86 |

2,916.53 |

2,379.29 |

1,456.67 |

956.75 |

|

Total Assets |

3,068.89 |

3,051.15 |

2,498.38 |

2,591.19 |

2,198.83 |

|

Contingent Liabilities |

309.56 |

286.89 |

32.15 |

68.09 |

107.29 |

|

Book Value (Rs) |

76.36 |

74.23 |

70.43 |

69.37 |

66.69 |

Dividend History

Index and Company Price Movement Comparison

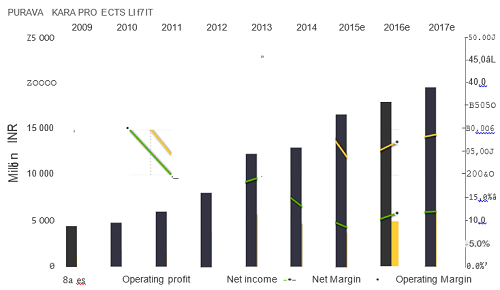

Company Forecast

Technical Indicators

|

Symbol |

Value |

Action |

|

RSI(14) |

55.036 |

Buy |

|

STOCH(9,6) |

25.361 |

Sell |

|

STOCHRSI(14) |

100.000 |

Overbought |

|

MACD(12,26) |

-0.060 |

Sell |

|

ADX(14) |

54.472 |

Buy |

|

Williams %R |

-36.364 |

Buy |

|

CCI(14) |

140.8805 |

Buy |

|

ATR(14) |

0.1643 |

Less Volatility |

|

Highs/Lows(14) |

0.0964 |

Buy |

|

Ultimate Oscillator |

56.483 |

Buy |

|

ROC |

0.535 |

Buy |

|

Bull/Bear Power(13) |

0.1460 |

Buy |

Important Ratios (YoY)

-

PBIT – 30.85 v/s 47.08

-

RoCE – 11.14 v/s 12.70

-

RoE – 7.86 v/s 9.57

-

Net Profit Margin – 10.97 v/s 13.72

-

Return on net worth – 5.85 v/s 7.08

-

D/E Ratio – 0.69 v/s 0.93

-

Interest Cover – 1.70 v/s 1.76

-

Current Ratio – 1.92 v/s 1.84

-

Reserves – 1692.32 cr v/s 1477.42 cr

-

PAT – 106.03 cr v/s 112.28 cr

-

Total assets – 3068.89 cr v/s 3051.15

-

Net sales – 922.68 v/s 815.26

-

Book Value – 76.36 v/s 74.23

Simple Moving Average

|

Days |

BSE |

NSE |

|

30 |

76.38 |

76.46 |

|

50 |

78.51 |

78.54 |

|

150 |

88.09 |

88.15 |

|

200 |

92.68 |

92.77 |

Investment Rationalize

-

Puravankara Projects Ltd. is one of the most reputed player of the Indian real estate industry with sales of Rs.922 crore and reveres of Rs.1692 crore.

-

In India real estate is considered as one of the most preferred investment destination and most of Non Resident Indians (NRI) investment is being done in real estate.

-

Puravankara Projects Ltd is able to generate and increase revenue even in the adverse market situations and the cost of debt is currently at 14.8%, which is continuously decreasing in the last three years.

-

Improvement in economic condition along with reduction in interest rates and increase in number of nuclear families with modern view on high quality living space will increase the sales of the company.

-

The inventory of the company stands at Rs.2218 crore, Puravankara will be able to capitalize of inventory when the demand picks up.

-

The projects of the company are mostly located in Bangalore, Chennai, Kochi, Coimbatore, Hyderabad, etc which is quickly becoming real estate hubs of the nation.

-

The time taken for completing the projects is among the lowest among the industry which adds to the competitive advantage of the company.

-

The stock is trading at Rs.65 which is below the Book Value of Rs.76 and Price to sales Ratio of the company stands at 1.68, which means the stock is available at discounted price.

-

Revenue from fully owned subsidiaries such as Provident Housing, which among the top player in economy housing segment will add to the profits of the company along with its projects in Colombo and United Arab Emirates.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.