Kolte Patil Developers

Kolte-Patil Developers Limited - Background

Kolte-Patil Developers Limited (KPDL) is an India-based construction company. The Company is engaged in business of construction of residential, commercial, and information technology (IT) parks along with renting of immovable properties and providing project management services for managing and developing real estate projects. KPDL has developed and constructed over 48 projects, including 35 residential complexes, nine commercial complexes, and four IT parks covering a saleable area of over 10 million square feet across Pune and Bangalore. Its projects include Tuscan Estate, 24K Glitterati, 24K Allura, City Centre, City Bay, City tower, Ispace, Giga Retail, Shopper’s Orbit and Bizzbay, among others.

|

BSE Code |

532924 |

|

NSE Code |

KOLTEPATIL |

|

Reuters Code |

KOLT.NS |

|

CMP (as on 19/01/2016) |

112.50 |

|

Stock Beta |

1.97 |

|

52 Week H/L |

240/112 |

|

Market Cap (Cr) |

852.47 |

|

Equity Capital (Rs cr) |

75.77 |

|

Face Value (Rs) |

10 |

|

Average Volume |

62326 |

|

|

|

|

Shareholding Pattern (%) |

|

|

Promoters |

74.54 |

|

Non Institutions |

25.46 |

|

Grand Total |

100 |

Kolte-Patil Developers Limited - Investment Rationale

-

Pune and Bangalore market to grow

-

Favorable interest rate cycle

-

Competitive pricing and product offering

-

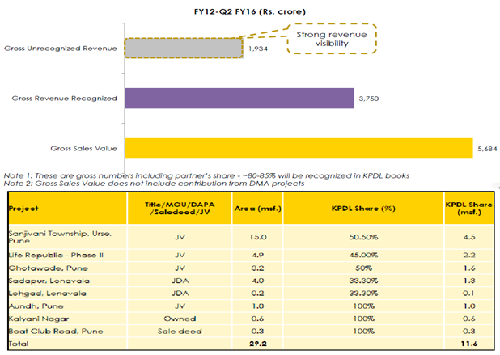

Strong revenue visibility

-

NRI investments

Kolte-Patil Developers Limited - Risks and Concerns

-

Limited presence

-

Unsold inventory

-

Cost fluctuations

Conclusion & Recommendation

KPDL being a dominant player in Pune and Bangalore real estate industry with high quality officering in both residential and commercial real estate. With ongoing projects, strong projects pipeline and revenue visibility we expect company to outperform the industry in the both medium term and long term future.

At the current market price of Rs.112.50 the stock is trading at ~9x FY17E EPS. Investors could buy the stock at CMP and add on dips to around Rs.103 to Rs.100 levels (~8x FY17E EPS) for our sequential targets of Rs.135 and Rs.160 (~11x to ~13x FY17E EPS).

Kolte-Patil Developers Limited - Financial Summary

|

Particulars (Rs. in Crs) |

FY2013 |

FY2014 |

FY2015 |

FY2016E |

FY2017E |

|

Net Sales |

712.9 |

755.05 |

691.6 |

760.76 |

867.27 |

|

Operating Profit |

228.59 |

235.99 |

216.08 |

242.63 |

305.87 |

|

PAT |

107.44 |

92.04 |

65.32 |

70.54 |

94.94 |

|

EPS (Rs.) |

14.18 |

12.15 |

8.62 |

9.31 |

12.53 |

|

PE (x) |

7.93 |

9.26 |

13.05 |

12.08 |

8.98 |

Kolte-Patil Developers Limited - Business Profile

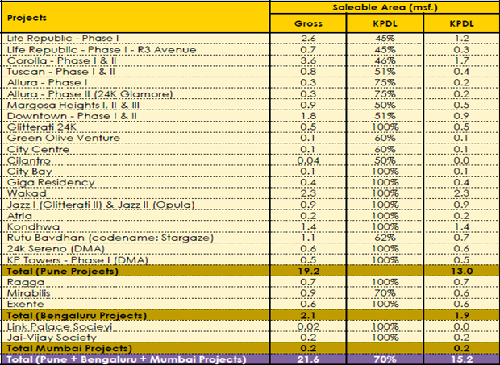

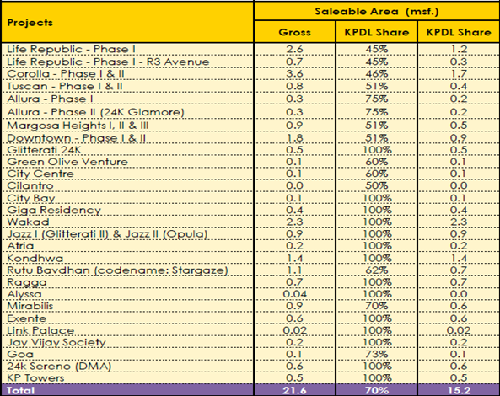

Project profile

Realizations

Investment Rationales

Favorable demographics

About 10million people are moving into cities annually. India has aspirational young population, rising urbanization, a growing middle-class population with high disposable income, along the government’s liberal economic policies are the strong growth drivers for the sector. Urban areas are expected to contribute 70-75 percent to the nation's GDP by 2025. India’s Real Estate market size is expected to increase seven times by 2028 from USD 121 bn in 2013 to USD 853 bn. The housing sector alone contributes 5-6% to the country’s gross domestic product (GDP). Also, in the period between 2008 and 2020, the market size of this sector is expected to increase at a compound annual growth rate (CAGR) of 11.2%. Retail, hospitality, and commercial real estate are also growing significantly, providing the much-needed infrastructure for India’s growing needs. In addition, real estate is now increasingly looked upon as an investment rather than a necessity. These trends augur well for the sector as a whole and KPDL in particular, which has a strong presence in Bangalore and Pune.

Pune and Bangalore market to grow

Pune is the eighth largest Indian city and the sixth-largest metropolitan region in India with a population of ~5.6 million. The Mumbai-Pune corridor comprises a population of 35.6 million and GDP of over H4 trillion. Pune is the second largest industrial hub and the third largest IT hub in India with 38 of India’s 88 functional IT parks and 24 SEZs focused on IT, ITeS and biotech. Pune is an end-user-driven real estate market, home to several manufacturing and auto ancillary companies and a site for the burgeoning sector of IT/ ITeS, financial services, KPO and biotech firms The outlook for the Pune realty market appears strong as auto majors (Tata Motors, Mahindra & Mahindra and Volkswagen) committed investments of in and around Pune, coupled with substantial investments in regional infrastructure earmarked in expanding industrial activity and multimodal transportation networks. Bangalore delivered the highest average capital value appreciation in the mid-segment, driven by consumer demand, proposed infrastructure improvement and proposed SEZ and IT parks. Bangalore remained India’s strongest commercial market with new supply and absorption in excess of 10 million square feet. The robust growth in IT and e- commerce sectors led Bangalore to report a significant portion of pan- India share of commercial office space absorption. The outlook continues to be promising with office space recommitted in various IT parks that are under development and with a number of reputed corporates in different verticals planning to set up campuses in Bangalore. With the increase in demand for both residential and commercial real estate in Pune and residential real estate in Bangalore KPDL will be able to satisfy potential clients demands.

Favorable interest rate cycle

The Reserve Bank of India (RBI) has cut interest rates by 50 basis points in two rounds this year. Though the transfer of benefit by banks to their customers is much slower than expected, a few commercial banks are cutting interest rates for home loan seekers, giving the much needed boost to the sector. The positive effects of these cuts will become much more visible for the property for sale in India by the next year as those who are waiting for much deeper cuts will stop doing so and seal the deals. Easy payment plans are changing track to attract buyers into the residential markets. The prevalence of these schemes will help pick up buying properties in many cities as well as towns.

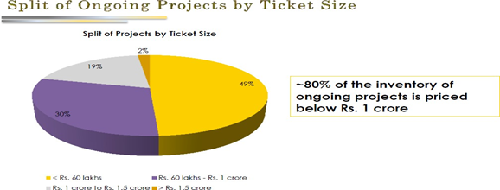

Competitive pricing and product offering

The mid-end apartment ie Rs.30 lakh to Rs.80 lakh business represents the largest segment at KPDL. The mid-end apartment segment fits well in the Company’s business model it addresses the largest volume segment in the industry’s demand pyramid, making it possible to generate attractive economies, translating into organizational sustainability. The segment makes it possible to generate customers for the present and future (should the customer intend to graduate, buy a second home or refer prospective buyers).

Marketing initiatives to pay dividends

Most residential real estate companies focus on marketing the product and location. KPDL has an external agency to research the health of the Kolte-Patil brand, prompting corrective action that would lead to the right collateral evoking the right image to realize the right price anywhere. It is among the first real estate companies to evolve from project-centric advertising to corporate brand building and designing communication that is customer-centric, evoking a conversation. It has targeted specific communities while marketing individual towers within our properties, helping create communities and accelerating off-take. The company generally sells around 25-30 percent of its apartment inventory at launch, creating attractive liquidity to take the project to a timely conclusion.

NRI investments

Having a property in India adds to a nostalgic value and is beneficial for NRIs from the business point of view, as they do not have to put in large investments thanks to the USD to INR conversion. Research has shown that NRI investment in India will increase to 35% this fiscal. NRIs investing in property, according to a recent survey, are eager to invest in cities like Delhi-NCR, Chandigarh, Ahmedabad, Pune, Mumbai, Kolkata, Bangalore, Hyderabad, Dehradun, and Chennai. This NRIs are mostly from countries like Australia, UK, Canada, the Middle East, the US, Singapore, and South Africa. The Indian government has also made sure to woo NRIs to invest in residential projects in India, as rules of FEMA (Foreign Exchange Management Act) and the Reserve Bank of India (RBI) has made investing in India easier for NRIs. There are also exciting offers to help them earn profits. Tax implications are also eased as the interest on a home loan is liable for deduction from NRI's taxable income, that too without any upper limit. NRIs looking to invest in ongoing projects in India, especially in the aforementioned cities, can expect good returns on investment. The increase in demand for properties in India&rsquo's urban cities brings forth the fact that the real estate market is still growing at a phenomenal rate. Witnessing an 87% increase in property rates just in the last decade, the whole realty sector in major cities, which includes the residential, commercial, retail, and hospitality verticals, is estimated to grow at 30% over the next decade. This implies a market size of a whopping $180 billion approximately by 2020. Whether you’ re a resident or an NRI, investment in Indian real estate is sure to give you returns that are much higher than what was anticipated a few years ago, this sentiment will work in favor of KPDL to increase its revenue mainly in high-end premium offerings.

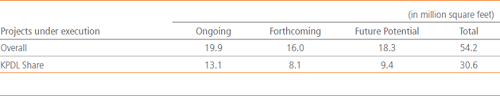

Strong revenue visibility

KPDL has over 20 million square feet of projects with key approvals. The Company is focused on activating projects during the course of the year and is optimistic that the success of these projects will translate into strong revenue and cash flow visibility. KPDL&rsquo's book, expected to improve revenue and profit trajectory in 2015-16 and 2016-17 as a greater proportion of 100%-owned projects as well as higher-margin projects like Jazz, Wakad, Rutu Bavdhan, Kondhwa, etc. hit the revenue recognition threshold.

Commercial and office space absorption to grow

Showing faith in India's economic growth, corporate occupiers have been lapping up office spaces for their expansion, which is reflected in the decline in office vacancy levels across the country to 15% from around 19% in 2013. The sharpest fall in pan-India vacancy levels is expected in 2016 and 2017 when it will ease below 13%. In Pune, it is down to 5% from 18%, Companies, especially in the eCommerce, telecom, and healthcare sectors, have been snapping up office space across major cities. India's office space absorption in 2015, at around 36 million sq ft, was the second-highest after 2011. Rentals across Indian cities rose in 2015 with the pace being faster in the secondary business districts (SBDs) and certain peripheral business districts (PBDs) of tier-I cities than in the established central business districts (CBDs). PDF with five ongoing projects from the price range from 48 lakh to 2.5 crores will be able to capitalize on the same.

Industry Overview

Introduction

The real estate sector is one of the most globally recognized sectors. In India, real estate is the second largest employer after agriculture and is slated to grow at 30 per cent over the next decade. The real estate sector comprises four sub-sectors - housing, retail, hospitality, and commercial. The growth of this sector is well complemented by the growth of the corporate environment and the demand for office space as well as urban and semi-urban accommodations. The construction industry ranks third among the 14 major sectors in terms of direct, indirect, and induced effects in all sectors of the economy. It is also expected that this sector will incur more non-resident Indian (NRI) investments in both the short term and the long term. Bangalore is expected to be the most favored property investment destination for NRIs, followed by Ahmedabad, Pune, Chennai, Goa, Delhi, and Dehradun.

Market Size

The Indian real estate market is expected to touch US$ 180 billion by 2020. The housing sector alone contributes 5-6 percent to the country's Gross Domestic Product (GDP). In the period FY08-20, the market size of this sector is expected to increase at a Compound Annual Growth Rate (CAGR) of 11.2 percent. Retail, hospitality, and commercial real estate are also growing significantly, providing the much-needed infrastructure for India's growing needs. Real estate has emerged as the second most active sector, raising US$ 1.2 billion from private equity (PE) investors in the last 10 months. Foreign investors have bought tenanted office space worth over US$ 2 billion in India in 2014, a four-fold rise compared to the previous year, in order to increase their rent-yielding commercial assets in Asia's third-largest economy.

Mumbai is the best city in India for commercial real estate investment, with returns of 12-19 percent likely in the next five years, followed by Bengaluru and Delhi-National Capital Region (NCR). Also, Delhi-NCR was the biggest office market in India with 110 million sq ft, out of which 88 million sq ft were occupied. Sectors such as IT and ITeS, retail, consulting, and e-commerce have registered high demand for office space in recent times. Delhi’s Central Business District (CBD) of Connaught Place has been ranked as the sixth most expensive prime office market in the world with occupancy costs at US$ 160 per sq ft per annum. While commercial real estate is expecting to see much action, residential housing may lag. Any benefit coming from the introduction of REITs is likely to remain confined to commercial real estate. While developers in the residential segment may not see REIT funds coming their way, other factors may play out in their favor. “The housing market is likely to see a shift from luxury towards affordable housing projects, with affordable price points hopefully leading to higher absorption levels. Developer emphasis on clearing inventory levels and meeting construction deadlines is seen as an encouraging step for the segment,” said the report.

Lower interest rates on home loans are one such factor that homebuyers, as well as developers, are waiting for. While the Reserve Bank of India reduced repo rates by 25 basis points in January, March, and September each, the expectation is high that it may go for a further rate cut. If that happens, and the lending institution passes on the benefit to home loans, potential homebuyers who have been sitting on the fence are likely to make a buy decision. While inflation worries seem to be easing over the past couple of months and economic growth is likely to improve in FY16, a change in consumer sentiment would require a perception of sustainability of these trends and an expected improvement in job and income prospects. Demand for real estate was impacted by weak consumer sentiments in 2014, driven by high inflation and weak economic growth. The easing of inflation and expectation of income growth will improve disposable income. At the same time, lower interest rates in FY16 will lead to lower equated monthly installments and thus higher loan eligibility. However, continued high prices of real estate remain a concern, as it may deter customers‟ purchase decisions until an actual improvement is seen in income and interest rates. No Signs of Easing of Prices Any fall in property prices will require steps for reduction of land costs, shortening of the approval process and removal of red tape, and also pressure from lenders on such companies to liquidate inventory to reduce debt. However, this is not likely to happen during FY16.

Government Initiatives

-

The Government of India along with the governments of the respective states have taken several initiatives to encourage development in the sector. The Smart City Project, where there is a plan to build 100 smart cities, is a prime opportunity for real estate companies. Below are some of the other major Government Initiatives:

-

India’s Prime Minister Mr. Narendra Modi approved the launch of Housing for All by 2022. Under the Sardar Patel Urban Housing Mission, 30 million houses will be built in India by 2022, mostly for the economically weaker sections and low-income groups, through public-private-partnership (PPP) and interest subsidies.

-

The Government of India has relaxed the norms to allow Foreign Direct Investment (FDI) in the construction development sector. This move should boost affordable housing projects and smart cities across the country.

-

The Securities and Exchange Board of India (SEBI) has notified final regulations that will govern real estate investment trusts (REITs) and infrastructure investment trusts (InvITs). This move will enable easier access to funds for cash-strapped developers and create a new investment avenue for institutions and high net worth individuals, and eventually ordinary investors.

-

The Government of Maharashtra announced a series of measures to bring transparency and increase the ease of doing business in the real estate sector.

-

The State Government of Kerala has decided to make the process of securing permits from local bodies for the construction of houses smoother, as it plans to make the process online with the launch of software called 'Sanketham'. This will ensure a more standardized procedure, more transparency, and less corruption and bribery.

Road Ahead

Responding to an increasingly well-informed consumer base and, bearing in mind the aspect of globalization, Indian real estate developers have shifted gears and accepted fresh challenges. The most marked change has been the shift from family-owned businesses to that of professionally managed ones. Real estate developers, in meeting the growing need for managing multiple projects across cities, are also investing in centralized processes to source material and organize manpower and hiring qualified professionals in areas like project management, architecture and engineering. The growing flow of FDI into Indian real estate is encouraging increased transparency. Developers, in order to attract funding, have revamped their accounting and management systems to meet due diligence standards.

Risks and Concerns

Limited presence

The offerings of KDPL are concentrated into limited geographies and it can affect the growth prospects of the company in a significant manner as it won’t be able to capitalize on demands in different markets.

Unsold inventory

KDPL have huge inventory of completed projects spared across different business verticals. Adverse demand situation can affect the inventory and it can hamper the company’s margins.

Cost fluctuations

The margins of the company is mainly depends on the cost expenses of the company. Increase in material cost and labour cost can adversely affect the margins of the company

Financials

Quarterly financial review

-

Total income from operations of Rs 155.02 crore and a net profit of Rs 13.18 crore for the quarter ended Sep '15.

-

For the quarter ended Sep 2014 the consolidated total income from operations was Rs 157.90 crore and net profit was Rs 12.71 crore.

-

Recorded 0.46 msf. of new sales bookings and new sales value of Rs. 282 crore.

-

Average price realization (APR) at Rs. 6,174/sft.

-

Collections were strong at Rs. 223 crore.

Q2FY16

|

|

2ndQtr201509 |

2nd Qtr201409 |

VAR % |

2ndQtr201509 |

1stQtr201506 |

VAR % |

|

Gross Sales |

154.14 |

156.72 |

-1.6 |

154.14 |

175.12 |

-12.0 |

|

Net Sales |

154.14 |

156.72 |

-1.6 |

154.14 |

175.12 |

-12.0 |

|

Other Operating Income |

0.89 |

1.18 |

-24.6 |

0.89 |

0.5 |

78.0 |

|

Other Income |

3.37 |

1.96 |

71.9 |

3.37 |

3.18 |

6.0 |

|

Total Income |

158.39 |

159.86 |

-0.9 |

158.39 |

178.81 |

-11.4 |

|

Total Expenditure |

114.24 |

116.09 |

-1.6 |

114.24 |

127.52 |

-10.4 |

|

PBIDT |

44.15 |

43.77 |

0.9 |

44.15 |

51.3 |

-13.9 |

|

Interest |

11.98 |

10.66 |

12.4 |

11.98 |

13.62 |

-12.0 |

|

PBDT |

32.17 |

33.11 |

-2.8 |

32.17 |

37.67 |

-14.6 |

|

Depreciation |

2.45 |

2.29 |

7 |

2.45 |

2.34 |

4.7 |

|

PBT |

29.71 |

30.82 |

-3.6 |

29.71 |

35.34 |

-15.9 |

|

Tax |

11.8 |

11.08 |

6.5 |

11.8 |

13.91 |

-15.2 |

|

Reported Profit After Tax |

17.91 |

19.74 |

-9.3 |

17.91 |

21.43 |

-16.4 |

|

Minority Interest After NP |

4.73 |

7.03 |

-32.7 |

4.73 |

6.96 |

-32.0 |

|

NP after Minority Int & P/L Asso.Co. |

13.18 |

12.71 |

3.7 |

13.18 |

14.47 |

-8.9 |

|

|

|

|

|

|

|

|

|

PBIDTM(%) |

28.64 |

27.93 |

2.5 |

28.64 |

29.29 |

-2.2% |

|

PBDTM(%) |

20.87 |

21.13 |

-1.2 |

20.87 |

21.51 |

-3.0% |

|

PATM(%) |

8.55 |

8.11 |

5.4 |

8.55 |

8.26 |

3.5% |

Profit and Loss Account as per rough estimates

|

|

FY13 |

FY14 |

FY15 |

FY16E |

FY17E |

|

Gross Sales |

712.9 |

755.05 |

691.6 |

760.76 |

867.27 |

|

Excise Duty |

0 |

0 |

0 |

0 |

0 |

|

Net Sales |

712.9 |

755.05 |

691.6 |

760.76 |

867.27 |

|

Other Operating Income |

14.58 |

9.17 |

5.04 |

7.95 |

7.38 |

|

Other Income |

36.53 |

15.16 |

11.71 |

14.06 |

12.30 |

|

Total Income |

764.01 |

779.38 |

708.35 |

782.77 |

886.95 |

|

Total Expenditure |

535.42 |

543.39 |

492.27 |

540.14 |

581.07 |

|

PBIDT |

228.59 |

235.99 |

216.08 |

242.63 |

305.88 |

|

Interest |

36.35 |

45.67 |

43.96 |

44.56 |

45.13 |

|

PBDT |

192.24 |

190.31 |

172.12 |

198.07 |

260.74 |

|

Depreciation |

5.87 |

7.08 |

10.06 |

12.55 |

15.05 |

|

PBT |

186.37 |

183.23 |

162.06 |

185.52 |

245.69 |

|

Tax |

62.46 |

66.32 |

60.21 |

66.79 |

90.91 |

|

Reported Profit After Tax |

123.91 |

116.91 |

101.85 |

118.73 |

154.79 |

|

Minority Interest After NP |

16.47 |

24.87 |

36.53 |

48.19 |

59.85 |

|

Profit/Loss of Associate Company |

0 |

0 |

0 |

0 |

0 |

|

Net Profit after Minority Interest & P/L Asso.Co. |

107.44 |

92.04 |

65.32 |

70.54 |

94.94 |

Balance Sheet as per rough estimates

|

|

FY13 |

FY14 |

FY15 |

FY16E |

FY17E |

|

SOURCES OF FUNDS: |

|

|

|

|

|

|

Share Capital |

75.77 |

75.77 |

75.77 |

75.77 |

75.77 |

|

Reserves & Surplus |

684.03 |

678.61 |

703.47 |

730.28 |

772.99 |

|

Loan Funds |

141.44 |

170.43 |

179.03 |

187.63 |

196.23 |

|

Deferred Tax Liability |

0.69 |

0 |

0 |

0 |

0 |

|

Other Liabilities |

2.5 |

3.4 |

3.91 |

4.68 |

5.38 |

|

Total Liabilities |

904.43 |

928.21 |

962.19 |

998.36 |

1050.38 |

|

APPLICATION OF FUNDS: |

|

|

|

|

|

|

Fixed Assets |

11.55 |

18.53 |

15.49 |

18.95 |

20.812 |

|

Intangible Assets |

0.73 |

0.51 |

7.57 |

9.78 |

13.20 |

|

Loans |

0 |

0 |

0 |

0 |

0 |

|

Investments |

474.77 |

424.97 |

409.48 |

404.52 |

392.29 |

|

Current Assets, Loans & Advances |

395.02 |

562.83 |

712.84 |

774.82 |

879.19 |

|

Inventories |

253.92 |

437.78 |

538.17 |

602.48 |

693.86 |

|

Sundry Debtors |

42.32 |

52.39 |

37.92 |

39.81 |

37.61 |

|

Cash & Bank Balance |

51.65 |

11.92 |

16.27 |

21.48 |

21.51 |

|

Other Current Assets |

3.11 |

3.78 |

18.28 |

11.51 |

12.28 |

|

Loans & Advances |

44.02 |

56.97 |

102.21 |

99.54 |

113.93 |

|

Current Liabilities & Provisions |

103.16 |

314.38 |

436.51 |

470.27 |

536.32 |

|

Current Liabilities |

73.12 |

294.74 |

412.06 |

451.16 |

520.02 |

|

Provisions |

30.04 |

19.64 |

24.44 |

19.11 |

16.31 |

|

Net Current Assets |

291.86 |

248.45 |

276.33 |

304.55 |

342.86 |

|

Deferred Tax Assets |

0 |

0.27 |

0.7 |

1.13 |

1.56 |

|

Other Assets |

125.51 |

235.48 |

252.6 |

259.43 |

279.66 |

|

Total Assets |

904.43 |

928.21 |

962.19 |

998.36 |

1050.38 |

Conclusion and Recommendation

We are positive on KPDL, and recommend a buy at the current market price of Rs.112.50 and add on dips to around Rs.103 to Rs.100 for our sequential targets of Rs.135 and Rs.160 with stop loss maintained at Rs.95.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.