KEI Industries Limited

About The Company

KEI Industries Limited (KEIIL), established in 1968, is one of the leading manufacturers of Cables & Wires (C&W). The company's product portfolio ranges from Low Tension Wires (LTW) to Extra-High Voltage Wires (EHVW), Housing Wires (HW), and Winding Wires (WW), along with EPC (Engineering, procurement, and Construction) Turnkey Projects.

Product Portfolio of KEIIL

-

Cables:

KEIIL had a technical collaboration agreement with Switzerland-based Brugg Kabel AZ in manufacturing Extra-High Voltage (EHV) cables since 2017.

-

Housing Wires and Winding Wires Segment:

While Housing Wires caters to residential and commercial construction activities, winding wires with high-grade insulation provides their applications in submersible motors and pump manufacturers.

-

Stainless Steel Wires (SSW)

KEIIL manufactures stainless steel wires used in various sectors and finds application in industrial metal filters, electrical fencing, springs, wire forms, bearing rollers, wall ties, 1welding electrodes, surgical equipment, etc.

-

Turnkey Projects:

The primary services offered in this segment include design, engineering, supply, erection, testing, and commissioning of the various townships, smart cities, infrastructure development projects, rural and railway electrification projects, etc.

The Company Operates through 5 Manufacturing Plants as shown below:

|

Five Manufacturing Plants |

||

|

1 |

Bhiwadi |

Rajasthan |

|

2 |

Pathtredi |

Rajasthan |

|

3 |

Chopanki |

Rajasthan |

|

4 |

Rakholi |

Dadra & Nagar Haveli |

|

5 |

Chinchapadi |

Dadra & Nagar Haveli |

Product Images:

Manufacturing Capacity of the Plants is as below:

|

Manufacturing Capacity |

||

|

1 |

EHV Cables |

900 Kms |

|

2 |

HT Cables |

11,100 kms |

|

3 |

LT Power & Other Cables |

116,600 Kms |

|

4 |

Winding, Flexibles, & House Wires |

11,17,000 kms |

|

5 |

Stainless Steel Wires |

7,200 MT |

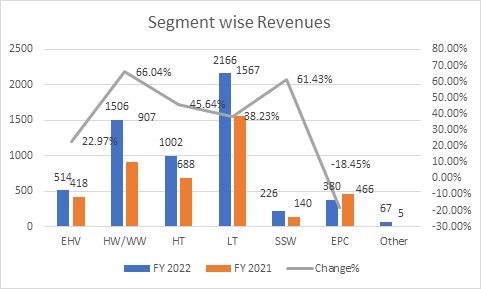

Performance of the Business - Product Wise & Segment Wise

|

FY 2022 |

FY 2021 |

Change% |

|

|

EHV |

514 |

418 |

22.97% |

|

HW/WW |

1506 |

907 |

66.04% |

|

HT |

1002 |

688 |

45.64% |

|

LT |

2166 |

1567 |

38.23% |

|

SSW |

226 |

140 |

61.43% |

|

EPC |

380 |

466 |

-18.45% |

|

Other |

67 |

5 |

|

FY 2021 |

FY 2020 |

Change% |

|

|

Retail |

34% |

29% |

17.24% |

|

Institutional |

51% |

53% |

-3.77% |

|

Exports |

15% |

18% |

-16.67% |

Business Profile Outlook:

-

KEIIL has a healthy order book of about Rs.2,000 Cr through its different revenue streams. The company is focusing on increasing the revenues from the retail segment due to the better profit margins.

-

To increase revenues from the retail segment, KEIL is expected to strengthen its workforce across various sales branches. The company also remains geared towards strengthening its distribution network and brand visibility through increased investments. Further, the company plans to invest in scaling up its LT, HT, and EHV cables capacity.

-

The company is expected to expand its global footprint across newer geographies and deepen its penetration in existing markets.

-

The company is trying to reduce its revenue contribution from the EPC projects, resulting in reduced inventory requirements and better working capital management.

-

Any delays in client's infrastructure projects, CAPEX deferments, sluggishness in the housing sector, and Volatility in the prices of Copper, Aluminium, Steel, and Nickel are considered to be the factors that can affect the growth of the company.

Key Financial Highlights of the company:

-

The company has clocked a growth of 27% in revenues at Rs.5,727 cr for the year 2021-22 compared to Rs.4,182 cr in FY 2021.

-

Revenues during the year 2020-21 fell by 14.39% compared to the previous fiscal because of the shutdown of the operations during the first quarter of the year due to the Covid-19 pandemic.

-

The company is maintaining consistent operating margins of around 10% to 11%, and the net profit margin of the company is about 6.5% for FY 2022.

-

The company has healthy working capital management with a current ratio of 2.22 and a quick ratio of 1.41.

-

KEIIL has reduced its debt and interest costs & debt to equity ratio has seen a considerable improvement from 1.79 in FY 2017 to 0.17 as of FY 2021.

Valuation and Recommendation:

At the current valuations, the price-to-sales ratio is 1.96. At similar valuations with an increased sales projection over the next year, i.e., at the end of FY23, we expect a price of Rs.1,533.00 per share with 25% expected growth.

We are recommending accumulating the stock from the current levels and the best buy levels we suggest buying is around Rs.1,100/- to Rs.1,175/-

For queries regarding investment planning and guidance, please call us at +91 7305923322 reach us at research@adityatrading.com

To read more reports on stocks please check, https://adityatrading.in/

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.