CENTURY TEXTILE&INDUSTRIES LIMITED

Century Textiles & Industries Limited - Company Profile

Incorporated in 1897, Century Textiles & Industries Limited manufactures cotton textile products and has a presence in the yarn, denim, caustic soda, sulphuric acid, salt, cement, and pulp and paper industries.

Century Textiles & Industries Limited 100 % cotton yarn unit and its denim unit are both situated in Madhya Pradesh. The cotton yarn unit has a capacity of 24,960 spindles and the denim unit produces 21 million metres of denim fabric per year.

Century Textiles & Industries Limited cement segment manufactures and markets cement and clinker products for use in water tanks, roads, bridges, dams, sea walls, turbine blocks, and residential or multi-storeyed buildings under the Birla Gold brand. The Company has three cement plants at different locations, with a total cement manufacturing capacity of 7.8 million tonnes per annum.

Century’s pulp and paper plant has a capacity of 31,320 tonnes per annum, writing and printing paper capacity of 1,97,800 tonnes per annum and a capacity of 36,000 tonnes per annum for tissue paper. Century Textiles & Industries Limited has set up a 500- tonnes per day multilayer packaging board plant adjacent to its existing pulp and paper plant at Lalkua, Uttarakhand.

Century Textiles & Industries Limited - STOCK INFORMATION

|

STOCK PRICE |

611.40 |

|

TARGET PRICE |

635-650 |

|

SECTOR |

CENTURY TEX |

|

SYMBOL (AT NSE) |

CENTURY TEX |

|

ISIN |

INE055A01016 |

|

FACE VALUE (IN RS.) |

2.00 |

|

BSE CODE |

500040 |

Century Textiles & Industries Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

5658.57 |

|

BOOK VALUE |

187.80 |

|

EPS - (TTM) (IN RS. CR.) |

- |

|

P/E |

- |

|

INDUSTRY P/E |

16.32 |

Technical observations

In the last few months, Century Textiles has been forming a base near 500. After making highs in September 2014, the stock witnessed profit booking and moved towards 500. Long liquidation was seen in the last couple of months as open interest declined to the tune of 20% from highs. How- ever, the stock has again started witnessing value buying at lower levels, which is also reflected in the fresh long additions. It suggests that the stock is getting ready for another round of up move.

The open interest in Century Textiles has increased sharply since the inception of the March series and added almost 18% open interest in the last couple of weeks. We believe fresh long positions in Century Textiles have been formed and they are looking for much higher returns. Recent up- sides in the stock have already triggered closure of short positions in the Call options segment. The highest open interest in Call options is placed at the 600 strike for the March series, which is already witnessing closure of positions. Further short covering is likely to be seen above this level.

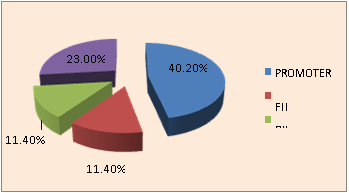

SHAREHOLDING PATTERN

RESULTS (Quarterly )(Rs CR.)

|

|

DEC' 14 |

SEP' 14 |

JUN' 14 |

MAR 14 |

DEC' 13 |

|

Sales |

1,847.57 |

1,705.83 |

1,887.37 |

1,849.07 |

1,639.33 |

|

Operat- ing profit |

96.24 |

155.67 |

204.94 |

183.47 |

168.05 |

|

Interest |

139.84 |

109.26 |

96.26 |

93.70 |

90.47 |

|

Gross profit |

-32.92 |

57.27 |

116.14 |

97.66 |

84.21 |

|

EPS (Rs) |

-6.83 |

0.08 |

7.15 |

-0.53 |

0.17 |

TECHNICAL VIEW

CENTURY TEXTILES LTD is looking strong on charts. We advise to buy around 605-615 with stoploss of 580 for the targets of 635-650 levels. RSI is also showing upside momentum in it on daily charts.

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

SKS MICRO |

BUY |

447.6 |

440-450 |

428 |

460-75 |

ONE WEEK |

|

UPL |

BUY |

440.74 |

435-440 |

430 |

445-52 |

ONE WEEK |

|

AUROPHARMA |

BUY |

1219.6 |

1200-1220 |

1170 |

1250-1280 |

ONE WEEK |

|

BHARTI AIRTEL |

SELL |

380.05 |

385-390 |

400 |

375-365 |

ONE WEEK |

|

RECL |

SELL |

324.45 |

330-335 |

340 |

325-320 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE / LOW/ HIGH |

|

ICICI BANK |

1250 |

SELL |

335-325 |

345 |

315-305 |

25000.00 |

BOTH TGT HIT |

318.40 / 303.30 |

|

JUBILANT FOOD |

250 |

BUY |

1580-1590 |

1550 |

1620-1650 |

-7000.00 |

SL TRG |

1524.30 / 1600.85 |

|

IRB |

1000 |

BUY |

235-240 |

230 |

245-250 |

10000.00 |

BOTH TGT HIT |

245.25 / 254.00 |

|

AUROPHARMA |

250 |

SELL |

1180-1200 |

1220 |

1150-1120 |

20000.00 |

BOTH TGT HIT |

1219.60 / 1113.00 |

|

REL CAPITAL |

500 |

SELL |

445-450 |

465 |

435-420 |

12500.00 |

BOTH TGT HIT |

427.50 / 418.00 |

|

REL INFRA |

500 |

SELL |

440-450 |

459 |

430-410 |

5000.00 |

FIRST TGT HIT |

426.45 / 419.40 |

|

NET PROFIT |

|

|

|

|

|

65500.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.