AXIS BANK LIMITED IPO

Axis Bank - Company Profile

Axis Bank, formerly UTI Bank was first of the new private banks in India to start operations after the Government of India allowed new banks to be established in the private sector. The Bank has been promoted by the largest financial institutions of the country, UTI, LIC, GIC and its subsidiaries. As at March 31, 2014, the Bank had a distribution network encompassing 2,402 domestic branches and extension counters and 12,922 ATMs situated in 1,636 cities and towns, compared to 1,947 domestic branches and extension counters, and 11,245 ATMs situated in 1,363 cities and towns last year. The Bank also has overseas offices in Singa- pore, Hong Kong, Shanghai, Colombo, Dubai and Abu Dhabi. For FY 2014, Axis Bank’s net interest margins stood at 3.81% (3.70 % for FY 2013). For the same period, net NPA’s stood at 0.40 % (0.32 % for FY 2013).

40.34% of the Bank’ operating revenue came from non-funded segments such as fees and commissions for services. 39 % of total deposits with the Bank were in the form of low cost CASA (current account and savings accounts) deposits on which the Bank pays a lower rate of interest which helps the Bank in maintaining a high rate of net interest margins.

Axis Bank - STOCK INFORMATION

|

STOCK PRICE |

618.10 |

|

TARGET PRICE |

650 |

|

SECTOR |

BANKS |

|

SYMBOL (AT NSE) |

AXIS BANK |

|

ISIN |

INE238A01034 |

|

FACE VALUE (IN RS.) |

2.00 |

|

BSE CODE |

532215 |

Axis Bank - STOCK FUNDAMENTALS

|

MARKET CAP |

140753.95 |

|

BOOK VALUE |

162.24 |

|

EPS - (TTM) (IN RS. CR.) |

0.00 |

|

P/E |

0.00 |

|

INDUSTRY P/E |

23.35 |

INVESTMENT RATIONALE

Axis bank reported strong core performance on back of strong NIM (3.93%) and healthy loan growth (23.2% YoY). Although operating profit came strong at 26.8% YoY on back of healthy revenue growth along with containment of opex (C/I ratio fell by 110bps QoQ), PAT (18.4% YoY) grew at moderate pace (in-line with our expectations) due to higher pro- visions (2.5x YoY). Reported NIM came at 3.93% in Q3FY15, much ahead of management's medium term guidance of ~3.50%, largely aided by improvement in LDR (410bps QoQ)

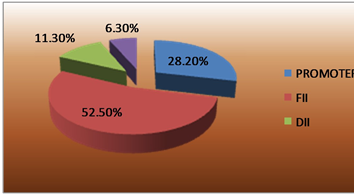

SHAREHOLDING PATTERN

OUTLOOK AND VALUATION

Although headline NPLs have been holding well contrary to street expectations, high exposure to non-operational power portfolio remains a potential risk, in our view. Fresh impairment (Rs.8.4 bn) remained way below the management's guidance (Rs.65 bn for FY15). However, management has maintained its earlier guidance by factoring in higher restructuring during Q4FY15 (Rs.20-21 bn in Q4FY15), as provisioning arbitrage ends between NPA and restructuring post FY15. At CMP, stock trades reasonable at 2.3x its FY17E ABV with healthy return ratios (RoE: 18- 19%, RoA: 1.8%). We are retaining BUY rating on the stock with revised TP of Rs.630-650.

RESULTS (Quarterly )(Rs CR.)

|

|

DEC' 14 |

SEP' 14 |

JUN' 14 |

MAR 14 |

DEC' 13 |

|

Sales |

2,700.16 |

2,627.57 |

2,509.13 |

2,443.31 |

2,342.70 |

|

Operat- ing profit |

2,607.59 |

2,552.26 |

2,432.52 |

2,363.08 |

2,278.70 |

|

Interest |

2,119.23 |

2,064.27 |

1,976.36 |

1,874.29 |

1,854.30 |

|

Gross profit |

523.99 |

519.11 |

490.61 |

523.43 |

458.07 |

|

EPS (Rs) |

6.82 |

6.76 |

6.39 |

7.33 |

6.47 |

TECHNICAL VIEW

AXIS BANK LTD is looking strong on charts. We advise to buy around 610-620with stoploss of 590 for the targets of 650 levels. RSI is also showing upside momentum in it on daily charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

84.406 |

OVERBOUGHT |

|

STOCH(9,6) |

56.452 |

BUY |

|

STOCHRSI(14) |

100.000 |

OVERBOUGHT |

|

MACD(12,26) |

8.760 |

BUY |

|

ADX(14) |

69.480 |

BUY |

|

WILLIAMS %R |

-12.322 |

OVERBOUGHT |

|

CCI(14) |

189.9302 |

BUY |

|

ATR(14) |

8.1714 |

HIGH VOLATILITY |

|

HIGH/LOWS(14) |

25.1786 |

BUY |

|

ULTIMATE OSCILLATOR |

25.1786 |

BUY |

|

ROC |

8.256 |

BUY |

|

BULL/BEAR POWER()13 |

39.3500 |

BUY |

|

BUY: 8 SELL:0 NEUTRAL: 3 |

SUMMARY : STRONG BUY |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

YES BANK |

BUY |

872.55 |

860-870 |

845 |

885-900 |

ONE WEEK |

|

AUROPHARMA |

BUY |

1089.5 |

1070-1085 |

1040 |

1120-1140 |

ONE WEEK |

|

CENTURY TEXTILE |

BUY |

538.75 |

525-535 |

519 |

545-570 |

ONE WEEK |

|

TATA MOTOR |

BUY |

602.85 |

595-605 |

585 |

615-625 |

ONE WEEK |

|

ICICI BANK |

BUY |

349.1 |

340-350 |

320 |

370-390 |

ONE WEEK |

Performance of Previous

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE/LOW/HIGH |

|

BHEL |

1000 |

BUY |

265-275 |

248 |

285-295 |

15000.00 |

NEAR TGT |

262.15 / 281.75 |

|

APOLLO HOSP |

250 |

BUY |

1320-1345 |

1295 |

1375-1420 |

-3750.00 |

SL TRG |

1329.50 / 1293.00 |

|

DIVIS LAB |

125 |

BUY |

1680-1700 |

1650 |

1740-1790 |

8750.00 |

FIRST TGT HIT |

1739.90 / 1757.05 |

|

HCL TECH |

125 |

SELL |

2000-2025 |

2060 |

1960-1920 |

7500.00 |

FIRST TGT HIT |

2041.95 / 1957.55 |

|

CROMPTON GREAVES |

1000 |

BUY |

175-180 |

170 |

185-190 |

-5000.00 |

SL TRG |

177.70 / 169.95 |

|

APOLLO TYRE |

2000 |

SELL |

185-188 |

192 |

182-178 |

12000.00 |

BOTH TGT HIT |

175.00/ 170.45 |

|

NET PROFIT |

|

|

|

|

|

34500.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.