AU Small Finance Bank Limited Research Report

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Bank |

660.75 |

Buy |

850 |

1-Year |

AU Small Finance Bank - Q1 FY 2023 Review

AU Small Finance Bank limited reported net revenue of ₹1,82,019.72 Lakhs for the quarter ended June 30, 2022, compared to ₹1,35,349 lakhs for June 30, 2021. Profit After Tax was ₹26,786.63 lakhs for the quarter ended June 30, 2022, compared to ₹20,319.79 lakhs during the corresponding quarter of the previous year, respectively.

AU Small Finance Bank - Investment Summary

|

CMP (₹) |

660.75 |

|

52 Week H/L |

733/462 |

|

Market Cap (crores) |

43,974 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

26.75 |

|

Non-Promoter Holding (%) |

73.25 |

|

Total (%) |

100.00 |

|

Book Value |

₹236 |

|

EPS TTM |

₹35.69 |

Overview

-

As of June 30, 2022, AU Small Finance Bank had 953 banking touchpoints and employees around 28,8883 people to serve 30.7 lakh customers in 20 states and 2 union territories.

-

Bank has been assigned AA+ and A1+ for the long-term and short-term loans by Crisil Rating Agency.

-

Allotment of 8,48,620 equity shares of the face value of ₹10 each to eligible employees under the stock option scheme.

Beta: 1.45 |

Alpha: 12.89 |

Risk Reward Ratio: 1.50 |

Margin of Safety: 22% |

AU Small Finance Bank - Quarterly Summary

|

Quarterly (INR in crores) |

Jun-22 |

Mar-22 |

Dec-21 |

Sep-21 |

Jun-21 |

|

Interest Income |

1,820 |

1,667 |

1,496 |

1,405 |

1,353 |

|

Interest Expended |

844 |

730 |

676 |

652 |

629 |

|

Net Interest Income |

976 |

937 |

820 |

753 |

724 |

|

|

|

|

|

|

|

|

Other Income |

159 |

311 |

276 |

192 |

215 |

|

Total Income |

1,135 |

1,248 |

1,096 |

945 |

939 |

|

|

|

|

|

|

|

|

Employee Cost |

394 |

414 |

356 |

327 |

283 |

|

Other Expenses |

347 |

352 |

282 |

226 |

174 |

|

Provision and Contingencies |

38 |

93 |

56 |

5 |

207 |

|

EBT |

356 |

389 |

402 |

388 |

275 |

|

|

|

|

|

|

|

|

Tax Expenses |

88 |

43 |

100 |

109 |

71 |

|

PAT |

268 |

346 |

302 |

279 |

203 |

Business

-

AU Small Finance Bank Limited was originally incorporated as L.N. Finco Gems Private Limited on 10 January 1996.

-

In the year 2000, the company received a certificate of registration under section 45IA of the RBI Act to carry on the business of non-banking financial institutions without accepting public deposits.

-

In 2003, developed a strategic relationship with HDFC Bank and went on to become the only ‘channel business partner’ for HDFC Bank in Rajasthan.

-

Between 2007-08, the company started offering secured business loans and Motilal Oswal Private Equity Advisors Private Limited invested in the company's first private equity capital.

-

Received ‘In-Principal approval’ for small finance bank from RBI on September 16, 2015.

-

The bank received its license on December 20, 2016.

-

The bank got listed on the NSE and BSE on 10 July 2017.

-

During FY 2021-22, the bank organized itself into 10 Strategic Business Units:

-

Branch Banking:

-

The cornerstone of the bank's banking franchise is branch banking.

-

It is fueled by the growth of the bank's branch network, the increasing contribution of retail deposits to the deposit portfolio, the emphasis on an optimum CASA mix, and the creation of an engaged client base.

-

-

Wheel:

-

The most seasoned book in the portfolio and one of the bank's main products is the auto loan.

-

The bank extends financing for both personal and business usage automobiles and has one of the broadest product lines in the industry.

-

-

Secured Business Loans (SBL):

-

SBL is one of the bank’s core offerings which cater to various business requirements of Micro & Small segments of the economy

-

-

Home Loans:

-

The objective is to provide a comprehensive range of home loan products to accommodate every home buyer’s loan needs, which focuses on an affordable housing society.

-

-

Commercial Banking:

-

To offer MSMEs, NBFCs, and real estate developers comprehensive banking services.

-

The bank provides a wide range of products, such as working capital, term loan, trade finance, and cash management solutions, to fulfill the asset and liability needs of customers.

-

-

Digital Banking:

-

To provide products and services like Personal loans, Credit Card, Insurance & Investments, Lending against digital merchant data, Mobile Banking, Net Banking, etc.

-

-

Credit Card:

-

The objective is to make credit available to all. The customers range from salaried employees to new to bank/first-time credit card holders.

-

-

Merchant Solution Group:

-

This SBU caters to all banking and financial needs of the MSME segment.

-

-

Treasury, DCM, and Wholesale Liability:

-

Asset liability management (ALM), efficient fund planning and positioning, day-to-day liquidity and fund management, managing statutory reserves following statutory guidelines, and prudently handling investments and trading portfolios following regulatory and internal policy frameworks are the primary responsibilities of the bank's treasury.

-

-

Financial and Digital Inclusion:

-

Building a society where every person is financially included in a way that improves livelihoods and promotes sustainable development is the goal of the Financial and Digital Inclusion SBU.

-

Financial inclusion is the process of ensuring transparent, affordable access to and use of high-quality financial services.

-

The main tool for facilitating reliable service delivery is digitization. Digital financial inclusion is the use of digital solutions to advance financial inclusion.

-

-

-

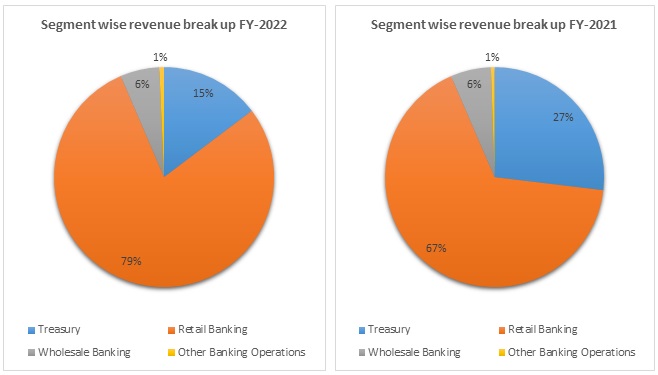

Out of the total revenue, 15% has been generated from Treasury operations, 6% from wholesale Banking, 79% from Retail Banking, and 1% from others in FY 2022 compared to 27%, 6%, 67%, and 1% in FY 2021, respectively.

AU Small Finance Bank - Revenue Trend

AU Small Finance Bank - SWOT ANALYSIS

-

Strength:

-

Experienced Management.

-

Strong Financial Position.

-

Building a strong retail Franchise Bank.

-

Healthy customer base.

-

-

Weakness:

-

Interest Rate risk.

-

Promoter shareholding is low.

-

Geographical Concentration risk.

-

Expensive replacement of current professionals.

-

-

Opportunities:

-

Advancement in Technology.

-

Growth Potential.

-

Branch Expansion.

-

-

Threats:

-

Increasing competition.

-

Ongoing uneven circumstances globally (e.g., Inflation).

-

Regulatory requirements.

-

Retention of Key Management Personnel.

-

AU Small Finance Bank - Ratio Analysis

|

|

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Interest Income |

5.50% |

5.40% |

5.30% |

5.70% |

|

Gross NPA |

2.00% |

1.70% |

4.30% |

2.00% |

|

Net NPA |

1.30% |

0.80% |

2.20% |

0.50% |

|

Provision Coverage Ratio |

37.40% |

52.50% |

49.70% |

75.00% |

|

Capital Adequacy Ratio |

19.30% |

22.00% |

23.40% |

21.00% |

|

CASA Ratio |

18,48% |

17.00% |

23.00% |

37.00% |

|

ROA |

1.50% |

1.80% |

2.50% |

1.90% |

|

ROE |

14.00% |

17.90% |

23.40% |

16.40% |

|

Cost to Income Ratio |

60.00% |

56.10% |

52.40% |

57.10% |

AU Small Finance Bank - Financial Overview

AU Small Finance Bank - Profit and Loss Statement (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Interest income |

1,767.19 |

2,949.13 |

4,285.88 |

4,950.05 |

5,921.73 |

|

Interest Expended |

826.73 |

1,606.53 |

2,376.94 |

2,584.61 |

2,687.61 |

|

Net Income |

940.46 |

1,342.60 |

1,908.94 |

2,365.44 |

3,234.12 |

|

|

|

|

|

|

|

|

Other income |

388.06 |

461.91 |

706.09 |

1,420.93 |

993.69 |

|

Total income |

1,328.52 |

1,804.51 |

2,615.03 |

3,786.37 |

4,227.82 |

|

|

|

|

|

|

|

|

Other expenses |

752.61 |

1,082.61 |

1,417.86 |

1,658.43 |

2,412.77 |

|

Provision and Contingencies |

283.87 |

340.10 |

522.39 |

957.26 |

685.21 |

|

|

|

|

|

|

|

|

PAT |

292.04 |

381.81 |

674.78 |

1,170.68 |

1,129.83 |

|

|

|

|

|

|

|

|

EPS |

|

|

|

|

|

|

Basic |

10.26 |

13.16 |

22.78 |

38.19 |

36.06 |

|

Diluted |

10.00 |

12.90 |

22.32 |

37.86 |

35.69 |

|

|

|

|

|

|

|

|

Number of shares |

|

|

|

|

|

|

Basic |

28.48 |

29.02 |

29.62 |

30.65 |

31.33 |

|

Diluted |

29.21 |

29.59 |

30.23 |

30.92 |

31.66 |

AU Small Finance Bank - Cash Flow Statement (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Profit Before Tax |

443.35 |

580.13 |

913.98 |

1,458.51 |

1,454.07 |

|

Net Cash from Operating Activities |

2,504.77 |

847.78 |

659.57 |

5,056.10 |

6,848.98 |

|

Net Cash Used for Investing Activities |

(1,889.55) |

(2,304.59) |

(1,267.45) |

(989.74) |

(4,753.37) |

|

Net Cash From (Used For) Financing Activities |

521.04 |

1,435.79 |

2,237.36 |

(2,654.70) |

(948.44) |

|

Net Increase in Cash and Cash Equivalents |

1,136.26 |

(21.03) |

1,629.49 |

1,411.66 |

1,147.18 |

|

Cash And Cash Equivalents at The Beginning of the Year |

624.96 |

1,761.22 |

1,740.19 |

3,369.68 |

4,781.34 |

|

Cash And Cash Equivalents at The End of the Year |

1,761.22 |

1,740.19 |

3,369.68 |

4,781.34 |

5,928.52 |

AU Small Finance Bank - Balance Sheet (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

CAPITAL AND LIABILITIES: |

|

|

|

|

|

|

Capital |

285.70 |

292.36 |

304.12 |

312.21 |

314.90 |

|

Money Received Against Share Warrants |

0.00 |

175.00 |

0.00 |

0.00 |

0.00 |

|

Employees’ Stock Options Outstanding |

17.50 |

42.94 |

52.12 |

103.12 |

41.33 |

|

Reserves and Surplus |

1,977.98 |

2,652.59 |

4,020.56 |

5,859.89 |

7,157.78 |

|

Deposits |

7,923.32 |

19,422.44 |

26,163.93 |

35,979.31 |

52,584.62 |

|

Borrowings |

7,638.86 |

8,613.36 |

10,335.32 |

7,029.70 |

5,990.78 |

|

Other Liabilities |

989.41 |

1,424.11 |

1,267.01 |

2,307.08 |

2,988.39 |

|

Total |

18,832.77 |

32,622.80 |

42,143.07 |

51,591.31 |

69,077.80 |

|

|

|

|

|

|

|

|

ASSETS: |

|

|

|

|

|

|

Cash and Balances with Reserve Bank of India |

492.12 |

811.14 |

1,049.64 |

1,569.35 |

2,468.41 |

|

Balances with Banks and Money at Call and Short Notice |

1,269.10 |

929.05 |

2,320.04 |

3,211.99 |

3,460.11 |

|

Investments |

3,050.59 |

7,161.67 |

10,668.22 |

10,815.41 |

15,306.50 |

|

Advances |

13,312.13 |

22,818.73 |

26,992.42 |

34,608.91 |

46,095.26 |

|

Fixed Assets |

386.09 |

447.03 |

448.00 |

482.37 |

622.57 |

|

Other Assets |

322.74 |

455.17 |

664.76 |

903.27 |

1,124.95 |

|

Total |

18,832.77 |

32,622.80 |

42,143.07 |

51,591.31 |

69,077.80 |

Industry Overview

-

The NPA ratio for public sector banks decreased from 9.4% in June 2021 to 7.2% in June 2022, while it decreased from 4.2% to 3.1% in the same month for private banks.

-

Asset quality in the banking sector has increased during the past year, helped by an uptick in economic activity. Even if concerns about restructured credit persist, bad loans decreased by around 185 basis points to 5.7% of all loans.

-

S&P Global Ratings projected that bad loans in India’s banking sector will decline to 5%-5.5% of gross loans by 31 March 2024. Credit costs are predicted to settle around 1.5% for FY23 and then normalize further to 1.3%, bringing them comparable to those of other emerging economies and the 15-year average for India.

-

According to rating agency ICRA, bank bad loan ratios are anticipated to further decrease to 5.2–5.3% by 31 March 2023 due to a lower slippage rate and stronger credit growth.

-

What is Small Finance Bank:

-

Small Finance Banks are a particular type of bank established by the RBI with the assistance of the Government of India to promote financial inclusion by primarily providing basic banking services to underserved and underrepresented groups, such as unorganized businesses, small and marginal farmers, micro and small industries, and small business units.

-

These banks can engage in all fundamental banking activities, such as lending and accepting deposits, just like regular commercial banks.

-

SFBs must adhere to strict requirements. At least 75% of the funds must be lent to the priority sector.

-

Moreover, loans up to Rs. 25 lakhs should make up at least 50% of the lending portfolio.

-

The RBI released the Small Finance Bank rules in November 2014 following the statement made during the Union Budget for the fiscal year 2014–15. Only 10 of the 72 businesses from various segments who filed for the license were given it on November 24, 2014.

-

-

SFBs are setting the standard for small loans to self-employed individuals whose credit histories are insufficient to determine their trustworthiness.

-

One percent of the Schedule Commercial Banks' total assets come from the group of small finance banks (SFBs). The total deposits and credit of SFBs increased by 32.7% and 23.1%, respectively, throughout the four quarters of 2021–2022.

-

While term deposits saw an increase of 15.7% (y-o-y) in March 2022, SFBs have been aggressively boosting their CASA deposits, raising their percentage of total deposits from 18.4% in March 2019 to 33.9% in March 2022.

-

SFBs' strong balance sheet expansion has raised concerns about asset quality from a low base. Their restructured standard advances portfolio is still above pre-pandemic levels but below the peak of September 2021.

-

These developments are influenced by SFB concentration in specific customer segments and geographic areas. However, their CRAR, which is greater than the wider group of SCBs, is still an acceptable 19.3% in March 2022.

-

At the end of March 2022, the gross non-performing assets (NPAs) of SFBs were 5%, down from above 6% in September 2021. Additionally, their net NPAs decreased from about 3.0% in September 2021 to 2.2% in March 2022.

Concall Overview (Q1FY2023)

-

The bank has developed a secured retail asset franchise throughout the years. Their portfolio is secured to 94%. Retail accounts for about 90% of the loan portfolio.

-

Regarding difficulties, inflation continues to be a crucial component that might affect the interest rate cycle and raise the bank’s OPEX.

-

To keep the cost-to-income ratio between 60% and 62%, the management is taking immediate action.

-

Due to good monsoons and festive seasons, Q3 and Q4 will likely support the annual business plan.

-

The bank has further progressed in having a pan-India presence, made its debut in Jharkhand, and has also forayed into the Northeast with the branch in Guwahati.

-

Added more than 2,000 employees in Q1FY2023.

-

Deposits grew by 48% Y-o-Y basis to ₹54,631 crores in Q1FY2023.

-

In Q1FY2023, gross advances were ₹49,349 crores.

-

CASA grew by 124% Y-o-Y basis to 49%.

-

Collection efficiency remained 100% in Q1FY2023.

-

The performance of restructured book has been quite positive, with slippages remaining at 15%, much lower than the estimation of 30%.

AU Small Finance Bank - Technical Analysis

-

Stock is trading below EMA 200 and MA 200 indicators, with a support level of ₹526 and a resistance level of ₹700.

-

One can accumulate this stock at current levels.

Peers Comparison

|

|

FY-2022 |

|||

|

|

GNPA |

NPA |

ROA |

ROE |

|

AU Small Finance Limited |

2% |

0.50% |

1.63% |

15.03% |

|

Equitas Small Finance Bank Limited |

4% |

2.47% |

1.04% |

11.31% |

|

Ujjivan Small Finance Bank Limited |

7% |

0.64% |

(15.92%) |

(1.75%) |

Recommendation Rationale

-

The bank has proven it can manage asset quality in the post-Covid environment and keep non-performing assets (NPAs) at a level below peers.

-

Despite increased provisioning requirements, the bank has maintained strong profitability indicators, as seen by the return on assets (ROA) figures of 1.59% and 1.28%, respectively, for fiscal 2020 and 2021. Due to consistent operating profitability and falling credit costs, the ROA for fiscal 2022 increased to 1.87%.

-

Apart from the bank's track record of raising need-based capital, continuous internal accruals support capitalization, which is adequate relative to the volume of operations of the bank.

-

The bank's capacity to maintain growth in its retail deposit franchise over the short to medium term, as demonstrated by a consistent rise in the proportion of retail deposits in the total deposit and overall liabilities base while maintaining a competitive cost of funds, will be a key rating factor.

-

Due to a significant emphasis on portfolio monitoring and collection procedures, AU Small Finance Bank Limited has maintained its asset quality throughout the last few years. Along with having a thorough understanding of the operating environment and borrower profile.

-

AU SFB is anticipated to maintain its net interest margin over the medium to long term thanks to strong market positions in key product categories and geographic regions that enable it to appropriately price in risk. Given that there are no significant expansion plans beyond the usual branch expansion in the medium term, operating expense ratios should stay at current levels.

-

Despite higher-than-industry-average growth, the scale of operations is still modest compared to peers in private banking.

-

Geographically, even though AU SFB has a long history of operations in Rajasthan, Maharashtra, Madhya Pradesh, and Gujarat, its portfolio is 79% concentrated in those four states, with Rajasthan alone making up 40% of the total AUM.

-

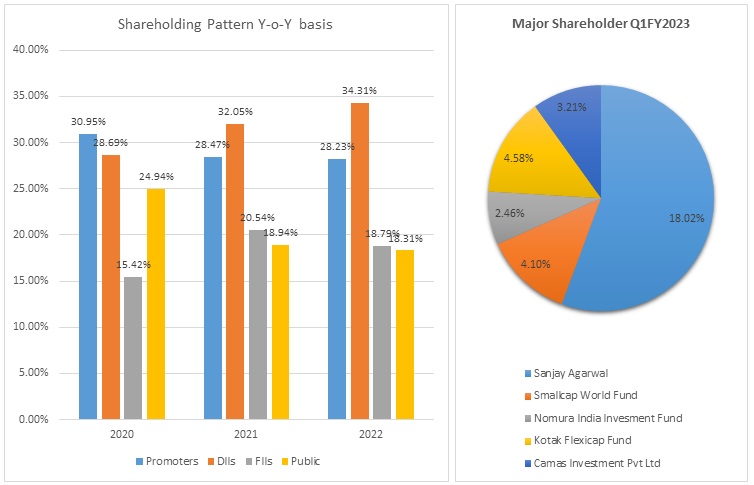

Promoter has reduced their shareholding by 0.02% to 28.21%.

-

Over 80% of the book's AUM is invested in retail loans, with Wheels making up the largest share at 37% and SBL coming in second at 34% of the book. Any unfavorable worldwide events, such as rising inflation or a recession, could affect the nation's overall economy, which could then affect firms and consumer spending, ultimately having an indirect impact on the financial sector as a whole.

Valuation

-

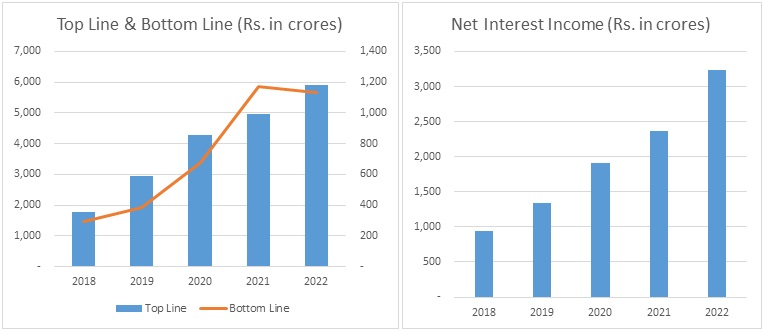

The Bank’s Net Interest Income has increased at a CAGR of 36% from FY 2018-2022

-

If the sale of Aavas Financiers Limited's investment is excluded, Net Profit After Tax for FY 2021–22 climbed to 1,129.83 crores from 600.23 crores, representing a YoY growth of 88.23%.

-

On March 31, 2022, Gross NPA and Net NPA were 1.98% and 0.50%, respectively, down from 4.25% and 2.18%, respectively, on March 31, 2021, due to improvements in collection effectiveness and asset quality.

-

We anticipate the company could generate higher Net Interest income for the following FY 2023, comparable to the prior year, based on the company's present performance in FY 2022.

-

The bank issued 31,50,93,233 equity bonus shares (ratio 1:1) as on 10 June 2022.

-

We used data from the last five years (2018-2022) to anticipate revenue for the fiscal years 2023–2027.

AU Small Finance Bank - Estimated Income Statement (₹ in crores)

|

|

Mar-23 |

Mar-24 |

Mar-25 |

Mar-26 |

Mar-27 |

|

|

2023-E |

2024-E |

2025-E |

2026-E |

2027-E |

|

Interest income |

6,962 |

8,184 |

9,622 |

11,312 |

13,299 |

|

Interest Expended |

2,876 |

3,077 |

3,292 |

3,523 |

3,770 |

|

Net Interest Income |

4,086 |

5,107 |

6,329 |

7,789 |

9,529 |

|

|

|

|

|

|

|

|

Other income |

1,043 |

1,096 |

1,150 |

1,208 |

1,268 |

|

Total income |

5,129 |

6,203 |

7,480 |

8,997 |

10,797 |

|

|

|

|

|

|

|

|

Other expenses |

2,584 |

3,038 |

3,572 |

4,199 |

4,937 |

|

Provision and Contingencies |

1,076 |

1,265 |

1,487 |

1,748 |

2,055 |

|

PAT |

1,469 |

1,900 |

2,421 |

3,049 |

3,805 |

-

We initiate coverage on AU Small Finance Bank Limited with a “Buy” and a 1-year Target Price of ₹850.

Disclaimer: This report is only for the information of our customers Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.