Acrysil (India) Ltd.

Acrysil (India) Ltd.

|

Current price |

220.00 |

|

Sector |

Kitchen Sinks |

|

No of shares |

4658000 |

|

52 week high |

714.90 |

|

52 week low |

220.10 |

|

BSE Sensex |

27890.13 |

|

Nifty |

8429.70 |

|

Average Volume |

7000 |

|

BSE Code |

524091 |

Acrysil India Ltd - Company Details

Acrysil Ltd is one the leading manufacturer and exporter of Composite Quartz Granite Kitchen Sinks in India. The company is engaged in the manufacture and sale of kitchen sinks in India. They offer granite kitchen sinks and stainless steel kitchen sinks. They market their sinks under the brand name 'Carysil'. The Company is also an original equipment manufacturer (OEM) for brands worldwide. The company is exporting their product to more than 40 countries which includes Poland, China, Malaysia, Greece, Great Britain, France, Bahrain, and USA.

The company’s products include granite sinks, stainless steel sinks, and wash basins. Its kitchen appliances comprise faucets, hoods and chimneys, hobs and cook tops, ovens and microwave ovens, food waste disposers, and wine chillers, as well as other free standing cooking products. The Company's granite sinks are manufactured in various range, such as jazz series, vivaldi series, beethoven series, single series, swan series, tango, and entertainment series. The Company’s stainless steel sinks range include quadro, trend, vogue, catwalk, diva, glamour, and big bowl. Acrysil is the only company in all of Asia - and one of just four companies worldwide - manufacturing composite quartz sinks. They are the India's largest sink manufacturer in the non-steel category and the company has set the goal to be the No. 1 manufacturer across all categories, in terms of branded volume.

Sternhagen, the German brand that symbolises the pinnacle of luxury in design and engineering will soon be launched in India. The brand, owned by Acrysil GmbH, Germany (a wholly owned subsidiary of Acrysil Limited, India). The Sternhagen collection of washbasins will initially have four nature inspired exclusive designs namely, Düne (inspired by sand dunes), Seerose (inspired by petals of water lily), Golden Cut (90° geometric cut design) and Kristall (inspired by natural crystal). The collection provides a subtle visual reminder of nature, and each design connects people with emotions and memories associated with nature. The washbasins are designed in Berlin, Germany by EMAMI DESIGN (No.1 of the worldwide Red Dot Design ranking). The current market capitalisation stands at Rs 246.91 crore.

Acrysil India Ltd - Share Holding Pattern

|

Category |

No. of Shares |

Percentage |

|

Promoters |

2,201,350 |

47.26 |

|

General Public |

1,418,747 |

30.46 |

|

Foreign - OCB |

452,400 |

9.71 |

|

Foreign - NRI |

313,929 |

6.74 |

|

Other Companies |

262,257 |

5.63 |

|

Others |

5,888 |

0.13 |

|

Directors |

3,204 |

0.07 |

|

Financial Institutions |

150 |

0.00 |

|

Central Government |

75 |

0.00 |

Acrysil India Ltd - Financial Details

-

Market Cap (Rs Cr) – 246.30

-

Company P/E (x) – 27.30

-

Industry P/E (x) – 54.82

-

Book Value (Rs) – 79.41

-

Price / BV (x) – 6.38

-

Dividend (%) – 40 %

-

EPS (TTM) – 18.61

-

Dividend Yield (%) – 0.79 %

-

Face Value (Rs) – 10

Acrysil India Ltd - Balance Sheet

|

|

Mar '14 |

Mar '13 |

Mar '12 |

Mar '11 |

Mar '10 |

|

Sources Of Funds |

|

|

|

|

|

|

Total Share Capital |

4.51 |

4.46 |

2.97 |

2.97 |

2.97 |

|

Equity Share Capital |

4.51 |

4.46 |

2.97 |

2.97 |

2.97 |

|

Share Application Money |

0.38 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Reserves |

33.72 |

27.40 |

25.10 |

22.54 |

17.87 |

|

Networth |

38.61 |

31.86 |

28.07 |

25.51 |

20.84 |

|

Secured Loans |

27.95 |

20.83 |

13.79 |

16.24 |

9.00 |

|

Unsecured Loans |

5.18 |

4.11 |

2.62 |

0.88 |

1.84 |

|

Total Debt |

33.13 |

24.94 |

16.41 |

17.12 |

10.84 |

|

Total Liabilities |

71.74 |

56.80 |

44.48 |

42.63 |

31.68 |

|

Application Of Funds |

|

|

|

|

|

|

Gross Block |

54.04 |

46.88 |

39.19 |

35.89 |

30.48 |

|

Less: Accum. Depreciation |

26.21 |

22.08 |

18.63 |

15.51 |

12.84 |

|

Net Block |

27.83 |

24.80 |

20.56 |

20.38 |

17.64 |

|

Capital Work in Progress |

0.82 |

0.06 |

0.40 |

0.47 |

0.73 |

|

Investments |

7.40 |

5.19 |

1.09 |

0.33 |

0.00 |

|

Inventories |

21.29 |

16.27 |

10.45 |

9.80 |

9.70 |

|

Sundry Debtors |

24.39 |

20.06 |

14.86 |

16.23 |

10.86 |

|

Cash and Bank Balance |

2.04 |

1.86 |

1.47 |

0.83 |

0.88 |

|

Total Current Assets |

47.72 |

38.19 |

26.78 |

26.86 |

21.44 |

|

Loans and Advances |

12.97 |

7.97 |

9.26 |

7.15 |

5.10 |

|

Fixed Deposits |

0.00 |

0.00 |

0.00 |

0.26 |

0.15 |

|

Total CA, Loans & Advances |

60.69 |

46.16 |

36.04 |

34.27 |

26.69 |

|

Current Liabilities |

21.56 |

15.96 |

10.91 |

10.54 |

8.40 |

|

Provisions |

3.43 |

3.46 |

2.71 |

2.28 |

4.96 |

|

Total CL & Provisions |

24.99 |

19.42 |

13.62 |

12.82 |

13.36 |

|

Net Current Assets |

35.70 |

26.74 |

22.42 |

21.45 |

13.33 |

|

Total Assets |

71.75 |

56.79 |

44.47 |

42.63 |

31.70 |

|

Contingent Liabilities |

9.03 |

6.89 |

8.41 |

8.41 |

0.10 |

|

Book Value (Rs) |

84.80 |

71.46 |

94.46 |

85.85 |

70.12 |

Profit and Loss Account

|

|

Mar '14 |

Mar '13 |

Mar '12 |

Mar '11 |

Mar '10 |

|

Income |

|

|

|

|

|

|

Sales Turnover |

103.71 |

78.45 |

62.23 |

56.08 |

47.13 |

|

Excise Duty |

0.00 |

0.00 |

0.00 |

0.71 |

0.48 |

|

Net Sales |

103.71 |

78.45 |

62.23 |

55.37 |

46.65 |

|

Other Income |

0.77 |

0.81 |

0.89 |

0.44 |

-0.75 |

|

Stock Adjustments |

5.32 |

2.61 |

1.12 |

0.14 |

1.90 |

|

Total Income |

109.80 |

81.87 |

64.24 |

55.95 |

47.80 |

|

Expenditure |

|

|

|

|

|

|

Raw Materials |

58.96 |

43.64 |

33.17 |

24.70 |

21.45 |

|

Power & Fuel Cost |

3.59 |

3.22 |

2.49 |

2.11 |

1.90 |

|

Employee Cost |

6.98 |

4.81 |

5.57 |

5.14 |

4.31 |

|

Other Manufacturing Expenses |

3.62 |

2.78 |

0.36 |

0.43 |

0.33 |

|

Selling and Admin Expenses |

0.00 |

0.00 |

0.00 |

10.41 |

7.73 |

|

Miscellaneous Expenses |

18.50 |

13.80 |

11.92 |

1.06 |

0.84 |

|

Total Expenses |

91.65 |

68.25 |

53.51 |

43.85 |

36.56 |

|

Operating Profit |

17.38 |

12.81 |

9.84 |

11.66 |

11.99 |

|

PBDIT |

18.15 |

13.62 |

10.73 |

12.10 |

11.24 |

|

Interest |

3.44 |

2.66 |

2.12 |

1.63 |

0.95 |

|

PBDT |

14.71 |

10.96 |

8.61 |

10.47 |

10.29 |

|

Depreciation |

4.20 |

3.79 |

3.32 |

2.86 |

2.65 |

|

Profit Before Tax |

10.51 |

7.17 |

5.29 |

7.61 |

7.64 |

|

Extra-ordinary items |

0.00 |

0.00 |

0.00 |

0.12 |

-0.17 |

|

PBT (Post Extra-ord Items) |

10.51 |

7.17 |

5.29 |

7.73 |

7.47 |

|

Tax |

2.54 |

1.66 |

1.37 |

1.68 |

1.57 |

|

Reported Net Profit |

7.98 |

5.50 |

3.94 |

6.10 |

5.91 |

|

Total Value Addition |

32.69 |

24.61 |

20.33 |

19.15 |

15.10 |

|

Equity Dividend |

1.80 |

1.47 |

1.19 |

1.19 |

1.18 |

|

Corporate Dividend Tax |

0.31 |

0.25 |

0.19 |

0.19 |

0.20 |

|

Per share data (annualised) |

|

|

|

|

|

|

Shares in issue (lakhs) |

45.08 |

44.58 |

29.72 |

29.72 |

29.72 |

|

Earning Per Share (Rs) |

17.70 |

12.35 |

13.26 |

20.53 |

19.88 |

|

Equity Dividend (%) |

40.00 |

33.00 |

40.00 |

40.00 |

40.00 |

Dividend and Bonus History

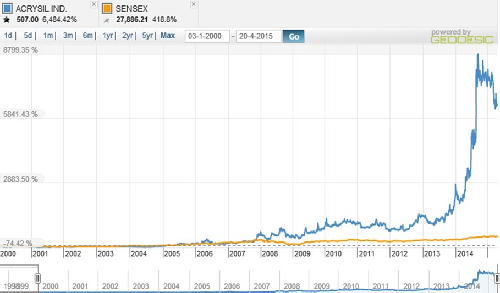

Index and Company Price Movement Comparison

Technical Indicators

|

Symbol |

Value |

Action |

|

RSI(14) |

63.615 |

Buy |

|

STOCH(9,6) |

66.966 |

Buy |

|

STOCHRSI(14) |

78.714 |

Overbought |

|

MACD(12,26) |

4.940 |

Buy |

|

ADX(14) |

24.813 |

Buy |

|

Williams %R |

-16.703 |

Overbought |

|

CCI(14) |

97.4447 |

Buy |

|

ATR(14) |

5.2893 |

High Volatility |

|

Highs/Lows(14) |

6.6357 |

Buy |

|

Ultimate Oscillator |

58.764 |

Buy |

|

ROC |

4.981 |

Buy |

|

Bull/Bear Power(13) |

7.0360 |

Buy |

Important Ratios (YoY)

-

PBIT – 12.62 v/s 11.37

-

RoCE – 19.75 v/s 17.28

-

RoE – 22.08 v/s 17.63

-

Net Profit Margin – 7.63 v/s 6.94

-

Return on net worth – 20.87 v/s 17.27

-

D/E Ratio – 0.87 v/s 0.78

-

Interest Cover – 4.06 v/s 3.70

-

Current Ratio – 0.88 v/s 0.79

-

Reserves – 33.72 cr v/s 27.40

-

PAT – 7.98 cr v/s 5.50 cr

-

Total assets – 71.75 cr v/s 56.76 cr

-

Net sales – 103.71 cr v/s 78.45 cr

-

Book Value – 84.80 v/s 71.46

Simple Moving Average

|

Days |

BSE |

NSE |

|

30 |

517.58 |

|

|

50 |

548.67 |

|

|

150 |

586.00 |

|

|

200 |

550.08 |

|

Investment Rationalize

-

Acrysil Ltd manufactures and sells kitchen sinks/centers with Quartz composite sink being a niche product, has no substitutes in the market.

-

Acrysil has tied up with some other German and Swiss companies for new products for both designing and technology. It is selling to some big retail chains in USA and Europe. This will assure quality and revenue growth.

-

The company launched a range of lifestyle kitchen appliances like faucets, hoods and chimneys, hobs and cook tops, ovens and microwave ovens, food waste disposers and wine chillers which will help the company to tap the market potential in more effective manner.

-

The Revenue has grown at an impressive CAGR of 17.1%, Asset Turnover of 1.22(x), sound ratios and margins and Reserves of Rs.33.72 crore which will help the company in expansion plans.

-

Only 20% of the companies revenue from India which implies huge growth potential of the affordable high quality fashionable products to the company to be sold in fast growing domestic market with more demand of branded kitchen products by the fast growing middle class population.

-

Companies expansion plans in both manufacturing and number of outlets will add to the growth potential of the company, as the number of nuclear families and real estate sector sentiment improves.

-

Being a capital intensive company Acrysil has been able to maintain fast and positive cash flow by having an impressive business model.

-

Revenue from untapped international market and fully owned subsidiaries will add to the Profit of the company.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.